Another week has passed and, even without a lot of economic data coming out, markets didn't look too good.

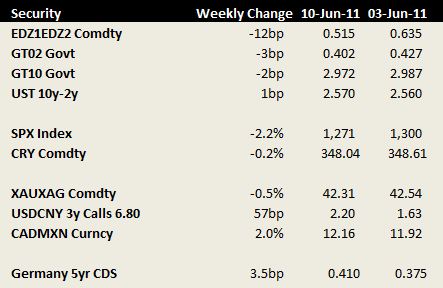

Below some securities changes and some of the bets that I like:

Below some securities changes and some of the bets that I like:

In terms of news flow we had some Fed people on the dovish side of the tape, but not enough to signal another round of QE.

We had some noise in Europe that brought Portuguese 10yr bonds to new highs and hit the Euro badly even after Trichet's hawkish comments. I am not sure if people are worried about the drain in liquidity after more signals that monetary policy will be tightened or if people think that activity isn't strong enough to resist to more tightening or even if this recent move was related to Germany x Greece or Bailout x Greece Referendum fears, etc, etc.. Anyway. I still like the long German 5y CDS bet @ 40bps I posted earlier. Politics will be the answer to the current debt mess and when politicians are involved I expect a bad outcome. Democracies could ruin the big-picture story for Europe. The True Finns in Finland had their go, some in Ireland also and the Greeks now hold the power (with help from the German people, for sure).

Still, I am not constructive at all with the US economy and with markets trading the way they are trading the economic activity should also slow down even more. And that is globally.

We had more hikes this week from Brazil and South Korea... that doesn't bode well for the global output. A surprising no-hike came from Peru also, but they're a much smaller piece of our puzzle.

Another piece of interesting news out was the Flow of Funds in the US... on that I bring 2 links:

Zero Hedge - Flow Of Funds Update: Aborted Attempt To Hand Over Releveraging From Government To Business Sector?

and

The Big Picture (Barry Ritholtz) - The Great QE2 Flush Out

Interesting facts... for the quarter ending March 31st we had household wealth up USD 1 trillion... of that some large numbers (1.2 trillion) from "corporate equities, mutual fund shares, and pension fund reserves". What has happened to household wealth since then with equity markets declining a bit and housing also declining in price? Will this be negative? Will it affect animal spirits and activity?

Anyway, technicals have turned horrible for a lot of assets and this week's move in stocks brought some of the indexes back to negative territory.

The NASDAQ is down YTD. The US Bank Index is down 10% YTD, the Trannies are now down YTD after holding up very well for weeks...

So...

Those useless weekly charts:

*Disclaimer: charts and data are presented as I receive/see them. Sources are usually not checked for validation and my own calculations are of 'back of the envelope'-type. I am aware that some math that I do myself might be wrong and/or misleading to some extent. In financial markets the rate of change of economic data is often more important than the actual level and the perception of 'what is priced in' is more important than 'what is actually going to happen'. This is actually the way people pick entry and exit points. So... yes, sometimes you might say 'This guy is an idiot, this is way wrong!' with a high conviction, being right. Not to worry. Markets are made of expectations and the clash of conviction between its participants. Portfolio managers know that being an idiot is sometimes profitable and being smart is often a bad choice. It is all reality, sometimes good, sometimes bad. By the way: corrections to my analysis and intelligent debate is welcome. theintriguedtrader AT gmail do com

No comments:

Post a Comment