Last week I posted charts on Italian bond yields.

I'm back with those today.

The 10y BTPS 2021 has erased all the tightening caused by the ECB buying.

And 30y BTPS 2040 is already past the previous highs.

Now lady, please consider that the ECB has spent 22bln + 15bln + 6bln + 13bln ~ 56bln EUR buying bonds.

With very, very temporary effect.

Consider that 1y Greek bonds dropped 10 points in 2 weeks.. now trading at 61% of face value. People are pricing in gigantic default probabilities.

Consider that the 20d moving average (there are seasonal aspects that difficult the analysis on the actual daily number) of the ECB Deposit Facility is back to mid-2010 levels.

Did you see Chinese Services PMI? It's below 2010 and 2009 levels for this time of the year.

Did you see Chinese New Export Orders that was released with the latest PMI figure last week? Down 2.1pts to 48.3. Into contraction territory. It last reached this level in March 2009.

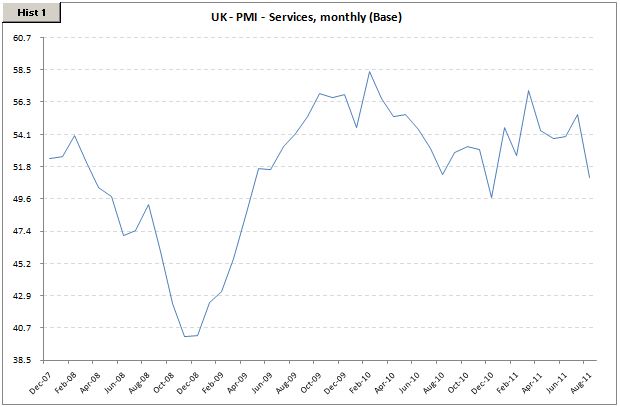

Did you see the UK's services PMI print? It dropped 4.3 points to 51.1.

The German DAX is down 30% from the highs and now equal the September 2009 levels.

The European Bank Index (SPEURO40) is down 40% and back to April 2009 levels. Just reminding you fellas that in March 2009 the SPX hit its low around 666 points.

The 10yr US Treasury yield is back to 2009's desperate days... 50 or 60 year lows.

George Soros said in his recent interview for Der Spiegel: "Markets are very good at predicting recessions. They cause it."

I think markets are influencing global economic growth right now....

I'm back with those today.

The 10y BTPS 2021 has erased all the tightening caused by the ECB buying.

And 30y BTPS 2040 is already past the previous highs.

Now lady, please consider that the ECB has spent 22bln + 15bln + 6bln + 13bln ~ 56bln EUR buying bonds.

With very, very temporary effect.

Consider that 1y Greek bonds dropped 10 points in 2 weeks.. now trading at 61% of face value. People are pricing in gigantic default probabilities.

Consider that the 20d moving average (there are seasonal aspects that difficult the analysis on the actual daily number) of the ECB Deposit Facility is back to mid-2010 levels.

Did you see Chinese Services PMI? It's below 2010 and 2009 levels for this time of the year.

Did you see Chinese New Export Orders that was released with the latest PMI figure last week? Down 2.1pts to 48.3. Into contraction territory. It last reached this level in March 2009.

Did you see the UK's services PMI print? It dropped 4.3 points to 51.1.

The German DAX is down 30% from the highs and now equal the September 2009 levels.

The European Bank Index (SPEURO40) is down 40% and back to April 2009 levels. Just reminding you fellas that in March 2009 the SPX hit its low around 666 points.

The 10yr US Treasury yield is back to 2009's desperate days... 50 or 60 year lows.

George Soros said in his recent interview for Der Spiegel: "Markets are very good at predicting recessions. They cause it."

I think markets are influencing global economic growth right now....

*Disclaimer: charts and data are presented as I receive/see them. Sources are usually not checked for validation and my own calculations are of 'back of the envelope'-type. I am aware that some math that I do myself might be wrong and/or misleading to some extent. In financial markets the rate of change of economic data is often more important than the actual level and the perception of 'what is priced in' is more important than 'what is actually going to happen'. This is actually the way people pick entry and exit points. So... yes, sometimes you might say 'This guy is an idiot, this is way wrong!' with a high conviction, being right. Not to worry. Markets are made of expectations and the clash of conviction between its participants. Portfolio managers know that being an idiot is sometimes profitable and being smart is often a bad choice. It is all reality, sometimes good, sometimes bad. By the way: corrections to my analysis and intelligent debate is welcome. theintriguedtrader AT gmail do com

Nice post. Do you think that all of the bad news you summed up is already known by the markets? Half of the global indices have fallen much more than 20%- a bear market. The DAX is already down so much as it has discounted at least all of the news public knows, plus some news we are yet to find out.

ReplyDeleteAnother recession will probably come, but maybe it won't come straight away. I personally believe it is not a good time to be bearish right now, as markets are now extremely oversold and there will be a strong multi month rally on the back of central bank / government intervention.

Yes, I agree with you that a lot has been discounted.

ReplyDeleteI have been watching funding/short-term credit indicators (cross-currency swap basis, Libor and Euribor fixings, financial stocks, financial credit spreads, etc) to gauge what is going on.

I am not good at adding to positions that have been into the money already, but I believe there is still downside from here and it could be a massive downside if you consider the lack of available bullets in policy makers' guns.

But as you said.. CBs and Governments are AT it. They won't sit and wait much. They'll be more pro-active (the Brazilian CB started already).

I think there might be good risk-reward in paying rates in the US... especially in the very front end of the curve.

Operation Twist, or whatever you want to call it, plus some Obama Job-Stimulus bill... it might make the 1y1y forwards gain some momentum upwards.

Perhaps a cheap hedge for bearish bets.

Nice post! Keep up the good work, I enjoy reading your point of view.

ReplyDelete