I haven't had much time to post my views on what is going on, but I will try to be brief and objective.

The 2008 Financial Crisis served for one purpose: to put the entire globe on the same economic cycle.

Business Cycles are now strongly correlated everywhere and the inter-connectedness of financial markets and the way capital flows globally has increased dramatically.

- We have seen austerity measures sweep the globe: Europe, US and some other places, such as Brazil too.

- We have seen an increase in interest rates throughout the past 18 months in many EM countries, in Europe, etc.

- We saw inflation surge in many places including places where food is very relevant in the average Joe's consumption basket.

- We have seen energy inflation increase remarkably too.

At the same time asset markets put on robust growth... pushing, through wealth effect, some growth upward.

Now, where debt loads are gigantic (US, Europe, Japan and in some other nations), we're finally seeing that there really isn't any growth absent massive fiscal and monetary stimulus.

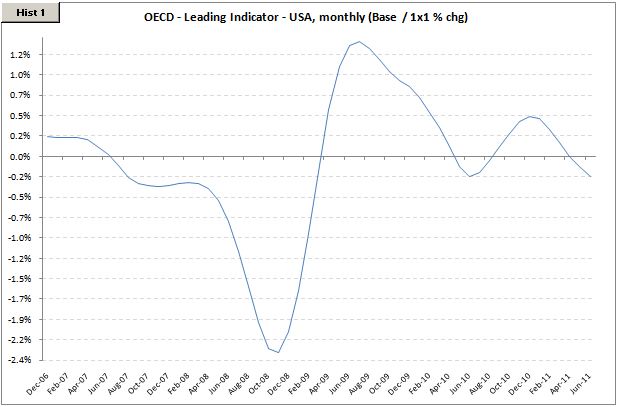

And since business cycles are correlated... we're seeing the charts below.

Now that confidence in more fiscal stimulus is waning... the outlook deteriorates sharply, markets respond accordingly and the bears come out of their caves.

I believe we're heading to another recession in DM and this time the weapons lack bullets.

The only available tool is money printing and currency debasement...

Check out the chart on EURNOK... It's making new lows despite the NOK being seen as a risk-on currency. The price action today of the SEK and the NOK, vs the EUR, was something like CHF style.

I am very bearish.

The 2008 Financial Crisis served for one purpose: to put the entire globe on the same economic cycle.

Business Cycles are now strongly correlated everywhere and the inter-connectedness of financial markets and the way capital flows globally has increased dramatically.

- We have seen austerity measures sweep the globe: Europe, US and some other places, such as Brazil too.

- We have seen an increase in interest rates throughout the past 18 months in many EM countries, in Europe, etc.

- We saw inflation surge in many places including places where food is very relevant in the average Joe's consumption basket.

- We have seen energy inflation increase remarkably too.

At the same time asset markets put on robust growth... pushing, through wealth effect, some growth upward.

Now, where debt loads are gigantic (US, Europe, Japan and in some other nations), we're finally seeing that there really isn't any growth absent massive fiscal and monetary stimulus.

And since business cycles are correlated... we're seeing the charts below.

Now that confidence in more fiscal stimulus is waning... the outlook deteriorates sharply, markets respond accordingly and the bears come out of their caves.

I believe we're heading to another recession in DM and this time the weapons lack bullets.

The only available tool is money printing and currency debasement...

Check out the chart on EURNOK... It's making new lows despite the NOK being seen as a risk-on currency. The price action today of the SEK and the NOK, vs the EUR, was something like CHF style.

I am very bearish.

*Disclaimer: charts and data are presented as I receive/see them. Sources are usually not checked for validation and my own calculations are of 'back of the envelope'-type. I am aware that some math that I do myself might be wrong and/or misleading to some extent. In financial markets the rate of change of economic data is often more important than the actual level and the perception of 'what is priced in' is more important than 'what is actually going to happen'. This is actually the way people pick entry and exit points. So... yes, sometimes you might say 'This guy is an idiot, this is way wrong!' with a high conviction, being right. Not to worry. Markets are made of expectations and the clash of conviction between its participants. Portfolio managers know that being an idiot is sometimes profitable and being smart is often a bad choice. It is all reality, sometimes good, sometimes bad. By the way: corrections to my analysis and intelligent debate is welcome. theintriguedtrader AT gmail do com

No comments:

Post a Comment