Another week and more fears, huh?

Italian and Spanish bond yields broke to the upside from that range we mentioned weeks ago and they certainly don't look any good.

The Stress Tests today were mild and sounded like good news, but I wonder, really, what is in there.

Some interesting facts are:

- US Electricity Output has come down YoY.

- US Railroad Freight Carloads are also down YoY.

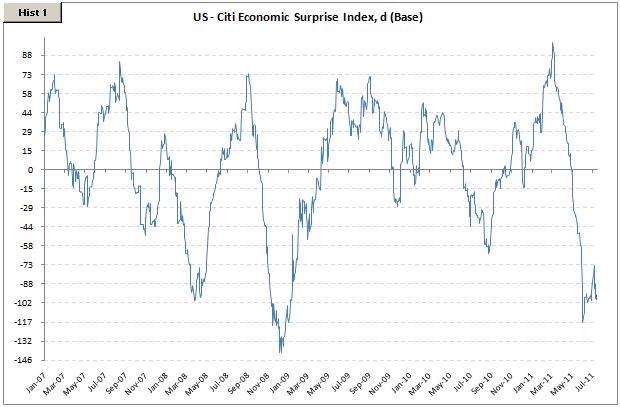

A lot of revisions to US 2Q and 3Q growth started to pop up and Bear-man-QE was, as expected, super dovish in his comments this week.

I am not seeing a lot of good macro trades on the table right now.

I like surfing what I got, but major new ideas are not cheap on the table.

Now to those charts no one cares about:

Italian and Spanish bond yields broke to the upside from that range we mentioned weeks ago and they certainly don't look any good.

The Stress Tests today were mild and sounded like good news, but I wonder, really, what is in there.

Some interesting facts are:

- US Electricity Output has come down YoY.

- US Railroad Freight Carloads are also down YoY.

A lot of revisions to US 2Q and 3Q growth started to pop up and Bear-man-QE was, as expected, super dovish in his comments this week.

I am not seeing a lot of good macro trades on the table right now.

I like surfing what I got, but major new ideas are not cheap on the table.

Now to those charts no one cares about:

*Disclaimer: charts and data are presented as I receive/see them. Sources are usually not checked for validation and my own calculations are of 'back of the envelope'-type. I am aware that some math that I do myself might be wrong and/or misleading to some extent. In financial markets the rate of change of economic data is often more important than the actual level and the perception of 'what is priced in' is more important than 'what is actually going to happen'. This is actually the way people pick entry and exit points. So... yes, sometimes you might say 'This guy is an idiot, this is way wrong!' with a high conviction, being right. Not to worry. Markets are made of expectations and the clash of conviction between its participants. Portfolio managers know that being an idiot is sometimes profitable and being smart is often a bad choice. It is all reality, sometimes good, sometimes bad. By the way: corrections to my analysis and intelligent debate is welcome. theintriguedtrader AT gmail do com

No comments:

Post a Comment