So it has been 3 weeks since my first post (here) when I defended that the economy would slow down with the end of QE2 and therefore would require extra fiscal and/or monetary stimulus (QE3?) to not collapse (less than 1% growth or double-dip).

The balance, so far, has been:

2yr US Treasuries: 20bps tighter

10yr UY Treasuries: 30bps tighter

US Dollar Index (DXY): -3.65% (US Dollar down, new lows)

US Dollar x Asian Currencies (ADXY): +1.25% (US dollar down, new highs)

June WTI: +3.20% (new highs)

SPX Index: +2.7% (new highs)

Gold: +7.08% (new highs)

Silver: +20.89% (new highs)

US Jobless Claims, 4k avg change: +18.3k

Housing prices (Case-Shiller) down, down, down.

The US Federal Reserve lowered its 2011 GDP growth-band: the highest is now 0.10% lower than the lower-bound of the previous range.

Most economists (GS, JPM, MacroAdvisors, etc) did so before the Fed.

Berna-man delivered a super conservative, neutral and as-expected-dovish speech at the April FOMC meeting Q&A.

ECRI Growth leading indicator: from 2.18% YoY to 0.38% YoY (top in Dec10 @ ~+5.0% YoY).

My reading of all this is that the market has indeed realized we'll witness sub-par growth (US Treasuries yields coming down across the entire curve) and that it is more likely that more accommodation will be required, thus boosting risk-assets and therefore lowering volatility.

Now curious facts:

Portuguese 2yr yields: +293bp (ouch!)

Portuguese 10yr yields: +104bp

Italian 2yr yields: +60bp

Italian 10yr yields: -1bp

Spainish 2yr yields: +18bp

Italian 10yr yields: +5p

Greek 2yr yields: +907bp (ouch!)

Greek 10yr yields: +285bp (ouch!)

And the EURUSD: +3.50%

Friday, April 29, 2011

Monday, April 25, 2011

How about some objectiveness?

So the global corporate world has been infected by the "fear syndrome" or the "omission syndrome".

That means people in offices are afraid to question bad ideas or reasoning. Or they simply remain silent when they see bad stuff happening. Why?

Hierarchy, politics, plain lack of experience.

These all play an important role here and it surely isn't positive for a business environment or fair to the people who work hard to make things happen.

People are not clear about their goals and others are afraid to step up.

And most of the time they are right not to do so because those on the other side of the line won't take criticism.

Too bad.

Below I present 120+ pages of Principles.

Those lines were written by Ray Dalio, founder of Bridgewater Associates.

Take some time and read them.

Hard-transparency helps wonders when both sides of the equation can work divergences out.

Bridgewater Associates- Ray Dalio and His Principles

That means people in offices are afraid to question bad ideas or reasoning. Or they simply remain silent when they see bad stuff happening. Why?

Hierarchy, politics, plain lack of experience.

These all play an important role here and it surely isn't positive for a business environment or fair to the people who work hard to make things happen.

People are not clear about their goals and others are afraid to step up.

And most of the time they are right not to do so because those on the other side of the line won't take criticism.

Too bad.

Below I present 120+ pages of Principles.

Those lines were written by Ray Dalio, founder of Bridgewater Associates.

Take some time and read them.

Hard-transparency helps wonders when both sides of the equation can work divergences out.

Bridgewater Associates- Ray Dalio and His Principles

Tuesday, April 19, 2011

Could the Fed make the banks go on a hiring spree?

After all, the banks are being paid by the Fed for a service... I presume.

I find it amusing to read these words from a PDF linked by the St. Louis Fed.

Below:

1. So far there has been little demand for these excess reserves.

2. Why would banks take on more risk when they, apparently, don't believe the risk-reward of lending at such low rates is any good.

3. Free money to help Uncle Sam sounds very nice to me. I'd take it.

So it explicitly says it is paying the banks a good spread over borrowing costs in order to 'stimulate growth' (or get some $ from tax payers?).

Man... I so wish the brazilian Treasury would get rid of its US Treasuries holdings and settle all its debt in USD to get no exposure to foreign currencies. We're doomed.

St Louis Fed - Quantitative Easing Explained

I find it amusing to read these words from a PDF linked by the St. Louis Fed.

Below:

If the money supply were to grow at a rapid rate, the resulting increase in economic activity could cause inflation to accelerate and expectations of future inflation to increase.The Fed, however, remains confident that its programs [read QE], including incentives for banks to retain their reserves, will prevent such an outcome. For example, the Fed pays banks interest on reserves at Fed banks. If the interest rate on these reserves is higher than the return banks could receive from alternative investments (the banks’ opportunity cost), reserves will remain idle.

2. Why would banks take on more risk when they, apparently, don't believe the risk-reward of lending at such low rates is any good.

3. Free money to help Uncle Sam sounds very nice to me. I'd take it.

So it explicitly says it is paying the banks a good spread over borrowing costs in order to 'stimulate growth' (or get some $ from tax payers?).

Man... I so wish the brazilian Treasury would get rid of its US Treasuries holdings and settle all its debt in USD to get no exposure to foreign currencies. We're doomed.

St Louis Fed - Quantitative Easing Explained

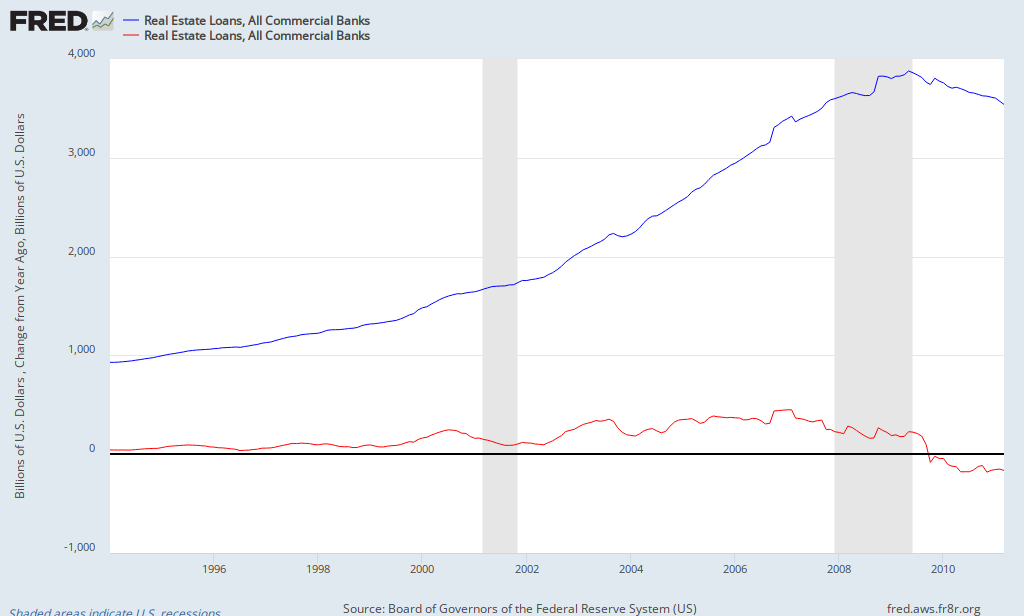

Will Housing affect the banks?

In the arm wrestling battle within the household wealth spectrum, which one would you consider more important to the US:

(a) stocks

(b) bonds

(c) real estate

Which of the 3 do you believe would affect banks balance sheets the most:

(a) stock

(b) bonds

(c) housing

Which of the 3 do you believe affects the average american spending habits the most:

(a) stock

(b) bonds

(c) housing

Which of the 3 do you believe affects consumer confidence the most:

(a) stock

(b) bonds

(c) housing

I'll give the ladies my humble opinion through a chart:

Blue Line: Real Estate loans at all Commercial Banks

Red Line: Real Estate loands at all Commercial Banks, YoY change in USD billions

Is that a re-acceleration of negative loan growth?

(a) stocks

(b) bonds

(c) real estate

Which of the 3 do you believe would affect banks balance sheets the most:

(a) stock

(b) bonds

(c) housing

Which of the 3 do you believe affects the average american spending habits the most:

(a) stock

(b) bonds

(c) housing

Which of the 3 do you believe affects consumer confidence the most:

(a) stock

(b) bonds

(c) housing

I'll give the ladies my humble opinion through a chart:

Blue Line: Real Estate loans at all Commercial Banks

Red Line: Real Estate loands at all Commercial Banks, YoY change in USD billions

Is that a re-acceleration of negative loan growth?

Resource Page and M2 x GDP growth

A very interesting page is certainly the FRED, Federal Reserve Economic Data, provided by the St.Louis Fed:

http://stlouisfed.org/

And within this page, the chartbook:

FRED: http://research.stlouisfed.org/fred2/

POPULAR SERIES: http://research.stlouisfed.org/fred2/popularseries

The kick-off:

Real GDP Growth x Money Stock:

1980:

Money Stock: USD 1.6 trillion

Real GDP: USD 6 trillion

2011:

Money Stock: USD 9 trillion

Real GDP: USD 13.5 trillion

Money Stock growth: 563% or 5.73% annualized

Real GDP growth: 225% or 2.65% annualized

So... how healthy has the American growth been?

http://stlouisfed.org/

And within this page, the chartbook:

FRED: http://research.stlouisfed.org/fred2/

POPULAR SERIES: http://research.stlouisfed.org/fred2/popularseries

The kick-off:

Real GDP Growth x Money Stock:

1980:

Money Stock: USD 1.6 trillion

Real GDP: USD 6 trillion

2011:

Money Stock: USD 9 trillion

Real GDP: USD 13.5 trillion

Money Stock growth: 563% or 5.73% annualized

Real GDP growth: 225% or 2.65% annualized

So... how healthy has the American growth been?

Monday, April 18, 2011

So last week we got some interesting data and price action.

Data out...

- UK

... some much lighter inflation numbers in the form of almighty CPI

... some worse than expected Jobless claims report, increasing claims instead of decreasing.

... average weekly earnings lighter than expected

... BUT the Unemployment Rate came in better than expected at 7.8% x 8.0%exp

- Germany

... slightly worse inflation numbers over there at Bierland

- US

... worse NFIB/IBD/TIPP Business Optimism numbers

... Import prices higher than expected

... worse trade balance numbers

... decent retail sales numbers that actually, in real terms, were flat-to-bad

... February's JOLTS Openings and Hires much better than January's... but Separations also came in higher... NFP-like Hires-Separations decreased MoM from 157k to 115k

... Fed's Beige book demonstrating economic improvement all over the place.

... Jobless claims coming in 32k higher than the 380k expected, worse number since first week of March.

... headline PPI came in a tad lighter, @ 70bp x 100bp expected

... core CPI coming in lighter as well @ 10bp x 20bp expected with headline in line @ 50bp

... Empire Manufactuing Index came in better than expected with Prices Paid, Employment and New Orders higher than last month

... UofMichigan Confidence slightly better than expected, but close to the lows of 2010-2011.

- China

... Increasing FX reserves... +64bln USD @ 3.044tri USD

... YoY growth in YUAN loans @ 33.7%, 679bln RMB

... 1Q Real GDP @ 2.1% QoQ / 9.7% YoY, expected was 9.4%

... CPI @ 5.4% YoY x 5.2%exp

... PPI @ 7.3% YoY x 7.2%exp

... Industrial Production higher than expected YoY @ 14.8% x 14.0%exp

... Retail Sales YoY @ 17.4% x 16.5%exp

... FAI, excluding Rural, YoY @ 25.0% x 24.8%exp

Perhaps I am seeing what I want to see, but despite a small dip in risk-markets and Fed officials talking about tigher policy... the USD remains very weak, US and global rates dropped a bit more in the past few days (besides european new-highs in periphery sovereigns) and US 1Q GDP numbers were demolished lower.

So... is the US economic growth as volatile as markets? Why would GDP come in weaker and weaker.. and then rise again despite QE2 ending and fiscal stimulus fading into the rest of the year?

I don't buy this idea of recovery in 2011... so I'll end the week leaving you ladies out there with one exciting link. John Taylor is manager of FX Concepts, an USD 8 billion (or so) hedge fund that bets in currencies. I'd like to make his words mine.

Data out...

- UK

... some much lighter inflation numbers in the form of almighty CPI

... some worse than expected Jobless claims report, increasing claims instead of decreasing.

... average weekly earnings lighter than expected

... BUT the Unemployment Rate came in better than expected at 7.8% x 8.0%exp

- Germany

... slightly worse inflation numbers over there at Bierland

- US

... worse NFIB/IBD/TIPP Business Optimism numbers

... Import prices higher than expected

... worse trade balance numbers

... decent retail sales numbers that actually, in real terms, were flat-to-bad

... February's JOLTS Openings and Hires much better than January's... but Separations also came in higher... NFP-like Hires-Separations decreased MoM from 157k to 115k

... Fed's Beige book demonstrating economic improvement all over the place.

... Jobless claims coming in 32k higher than the 380k expected, worse number since first week of March.

... headline PPI came in a tad lighter, @ 70bp x 100bp expected

... core CPI coming in lighter as well @ 10bp x 20bp expected with headline in line @ 50bp

... Empire Manufactuing Index came in better than expected with Prices Paid, Employment and New Orders higher than last month

... UofMichigan Confidence slightly better than expected, but close to the lows of 2010-2011.

- China

... Increasing FX reserves... +64bln USD @ 3.044tri USD

... YoY growth in YUAN loans @ 33.7%, 679bln RMB

... 1Q Real GDP @ 2.1% QoQ / 9.7% YoY, expected was 9.4%

... CPI @ 5.4% YoY x 5.2%exp

... PPI @ 7.3% YoY x 7.2%exp

... Industrial Production higher than expected YoY @ 14.8% x 14.0%exp

... Retail Sales YoY @ 17.4% x 16.5%exp

... FAI, excluding Rural, YoY @ 25.0% x 24.8%exp

Perhaps I am seeing what I want to see, but despite a small dip in risk-markets and Fed officials talking about tigher policy... the USD remains very weak, US and global rates dropped a bit more in the past few days (besides european new-highs in periphery sovereigns) and US 1Q GDP numbers were demolished lower.

So... is the US economic growth as volatile as markets? Why would GDP come in weaker and weaker.. and then rise again despite QE2 ending and fiscal stimulus fading into the rest of the year?

I don't buy this idea of recovery in 2011... so I'll end the week leaving you ladies out there with one exciting link. John Taylor is manager of FX Concepts, an USD 8 billion (or so) hedge fund that bets in currencies. I'd like to make his words mine.

Thursday, April 14, 2011

Are people eating iPads or buying new clothes?

Retail and Food Services... lowest growth since June 2010.

Are people spending on iPads and new clothes? Or perhaps in AAPL stock?

St Louis Fed - link

Are people spending on iPads and new clothes? Or perhaps in AAPL stock?

St Louis Fed - link

Bob, the bear

Nomura's Sceptical Strategist Bob Janjuah speaks about his belief that the markets will face tough times ahead giving the Federal Reserve Playboys and Uncle Sam few (bad) options to choose from.

Nomura - The Sceptical Strategists - Bob Janjuah - In Bob's world USDs are not welcome

Nomura - The Sceptical Strategists - Bob Janjuah - In Bob's world USDs are not welcome

Truth or dare?

http://imarketnews.com/node/29203

Monday, April 11, 2011 - 23:15

Beijing March New House Prices Plunge 26.7% M/M: Press

BEIJING (MNI) - Prices of new homes in China's capital plunged 26.7% month-on-month in March, the Beijing News reported Tuesday, citing data from the city's Housing and Urban-Rural Development Commission.

Average prices of newly-built houses in March fell 10.9% over the same month last year to CNY19,679 per square meter, marking the first year-on-year decline since September 2009.

Home purchases fell 50.9% y/y and 41.5% m/m, the newspaper said, citing an unidentified official from the Housing Commission as saying the falls point to the government's crackdown on speculation in the real estate market.

Beijing property prices rose 0.4% m/m in February, 0.8% in January and 0.2% in December, according to National Bureau of Statistics data.

The central government has launched several rounds of measures since last year designed to cool the housing market, though local government reliance on land sales to plug fiscal holes mean enforcement hasn't been uniform.

The NBS is expected to release March house price data on April 18.

beijing@marketnews.com ** Market News International Beijing Newsroom: 86-10-5864-5274 **

Wednesday, April 13, 2011

JOLTS Openings and Hires spring back up...

... confirming the good NFP numbers in February and March killing my post's logic...

...to some degree.

As shown below, Separations (+180k in Feb) also moved into the same direction making the NFP number not as strong as some expected, but still pretty good if you consider QE1, QE2, massive stimulus and other 'tiny details' that mark a normal recession.

Note:

http://www.bls.gov/news.release/jolts.htm

Separations Total separations includes quits (voluntary separations), layoffs and discharges (involuntary separations), and other separations (including retirements)

Tuesday, April 12, 2011

Escape-velocity... right!

The ISMs are still at high levels while small businesses and consumers show a different picture.

Very large drops in the NFIB small business optimism index... and its components show a not-too-great picture.

Absolute level also not great, still far below 2-decade average and hovering around the lows of the 2-decade period ending in 2006.

Table below looks interesting:

Table below looks interesting:

Are young americans getting student loans in order to really get a better education? Or would these lads, perhaps, get some parties going on or perhaps paying rent or mortgage bills? It'd be interesting to see if university enrollment has skyrocketed lately.

Considering the amount of stimulus in place (ZIRP, QE1, QE2, Fed's maturing MBS/Treasuries re-investment, 3-year old 99-week extended jobless benefits, maintenance of Bush's tax-cuts, payroll tax-cut, cash for clunkers, housing tax credit) I REALLY do not agree with consensus view that the economy has reached escape velocity because the recent non-farm payroll numbers were robust.

What other numbers would you point to as evidence of a strong rebound in economic activity?

Very large drops in the NFIB small business optimism index... and its components show a not-too-great picture.

Absolute level also not great, still far below 2-decade average and hovering around the lows of the 2-decade period ending in 2006.

Table below looks interesting:

Table below looks interesting:Now let's take a look at the Conference Board Consumer Confidence survey

And the Michigan Consumer Confidence.

First with Expectations. Largest drop in a long time and level is matching 2009's March. I can't remember very well, but that was the top of the Housing Bubble and the equity markets I would guess.

And the headline index also took a big dive. And the levels are superb, right?

Let me add 3 more interesting charts.

Below... NONREVNS-TOTALGOV is the line that includes Student Loans (two charts down, as Total Government) and we get the green line, the steepest downward line. But "credit is starting to show signs of improvement". Indeed, not falling too fast is technically better.

Are young americans getting student loans in order to really get a better education? Or would these lads, perhaps, get some parties going on or perhaps paying rent or mortgage bills? It'd be interesting to see if university enrollment has skyrocketed lately.

What other numbers would you point to as evidence of a strong rebound in economic activity?

Friday, April 8, 2011

How can the U.S. recovery be strong when job Openings/Hirings are weakening?

Regarding my contrarian “We will see another QE soon” point of view:

A lot of people say that the recovery depends on job growth.

And indeed, the NFP has been trending higher, levels not yet consistent with ‘escape velocity’, but sequential data coming in better each month pointing to better NFPs going forward.

JOLTS data was only released for January and the Feb data comes out next week. Employment = Lagging indicator, OK. So people say.

Below: monthly change in non-seasonally-adjusted of JOLTS Openings and Hires (to avoid S.A. modeling distortions):

Openings vs previous year’s same period (oct-jan, 4 months change):

Oct2009-Jan2010 = +255k openings

Oct2010-Jan2011 = +-42k openings

Momentum: -297k openings

Now same numbers for Hires:

Oct2009-Jan2010 = -669k hires

Oct2010-Jan2011 = -778k hires

Momentum: -86k hires

And the Seasonally-Adjusted Charts for both (because NSA charts tough to compare):

JOLTS – Openings SA

JOLTS – Hires SA

Notice that the changes in HIRES and OPENINGS have been to the negative side AND absolute levels for Hires look really close to the lows set in 2009 (around 3.6m).

So, lower job openings and hiring even though growth is picking up.

Hmmm. I find that quite interesting for an improving economy with wages already low and companies full of cash in their hands after a great run of profits.

Of course my logic can be completely wrong if we do get solid numbers for February and March JOLTS Openings+Hires, which now seem likely after 2 decent good NFP numbers, etc, BUT…

Then I compare the current path of economic numbers and of risk-asset prices to 2010’s 1H2010.

Then the fact that Oct 2009-Apr10:

- the last months of QE1 + extended jobless benefits (later extended) + etc,

- housing tax rebates,

- cash for clunkers,

- until April the S&P and other markets were making new highs,

- among many other positive tail winds.

Currently we have about the same background (strong risk-markets, weaker USD, better activity numbers on the margin, robust ISMs, ongoing extended unemployment benefits) and the payroll tax cut which has supposedly injected USD 50bln+ in the economy.

QE2 is ending later in this year than QE1 did (June x April/May) in 2010 and, as you expect and so do I, the Fed is likely to keep the size of its balance sheet unchanged, re-investing the proceeds from maturing MBS/Treasuries. The Fed won’t make the same mistake of 2H2010.

Since I now believe that QE doesn’t feed into the economy through much lower rates, but rather through the wealth effect since the Fed clogs the investment opportunities … (think of investors’ USD 600bln that instead of buying Treasuries due to too-low rates go into corporate bonds or equities or anything else. No demand for credit = low rates have timid impact)

Right now:

A) Real Estate prices are again on a downtrend (and that’s a lot more wealth for the average american consumer than stocks and bonds),

B) Does the wealth effect, for consumers and companies, feed into the economy through level of risk-assets prices or the marginal-change in risk-assets prices?,

C) Consumer confidence has collapsed back to really low levels

D) Number of foreclosures not helping housing or confidence…

E) Durable goods recent data suggests the corporations are not really believing we have a strong recovery in hands. CapEx is still too low.

From LPS’ First Look/Mortgage Monitor:

Total U.S. loan delinquency rate: 8.8%

Total U.S. foreclosure inventory rate: 4.15%

Total U.S. non-current inventory: 6,856,000

States with most non-current loans: Florida, Nevada, Mississippi, New Jersey, Georgia

States with fewest non-current loans: Montana, Wyoming, Alaska, South Dakota, North Dakota

The LPS report also noted that “February’s data also showed a 23 percent increase in Option ARM foreclosures over the last six months, far more than any other product type. In terms of absolute numbers, Option ARM foreclosures stand at 18.8 percent, a higher level than Subprime foreclosures ever reached.”

Add higher core inflation across the world (visible in Brazil where real estate prices, rent and services have risen considerably in the past 2 years)

Add EMs tighter monetary stance since 2010 and on a path to even tighter rates forward.

Add the ECB tightening its policy rate.

Add higher food prices + crude

Add to that AAA reported gasoline prices now 32% higher than the same period of 2010, 22% higher since 1-Jan-2011 (3AGSREG Index on Bloomberg)

After QE2 is done with… will the US economy surprise to the UPSIDE considering Q1 2011 is likely below 3%?

If you consider the amount of monetary and fiscal stimulus impacting the US in the past 3 years and the recovery in our hands…. Are we able to say that growth is really sustainable without all the stimulus? Is the US going to give us 3-4% growth year in/year out AFTER we’ve exhausted already-in-place options?

That is why I believe the “steady balance sheet” policy we’re likely to see after June will not be able to support 3/4% GDP-economic activity and the Fed (or the government)will be pushed into doing more QE (or fiscal stimulus).

What would you correct/suggest considering the variables we currently have in hand?

Thursday, April 7, 2011

A new blackboard...

So I will start using this space to organize my thoughts on global macro investing.

We're living through schizophrenic times.

Investors are changing their minds intra-minute.

Sell-side analysts and economists have missed massive turn arounds.

Governments and Central Banks have done the impossible.

Capitalism's face has changed.

And the future of the current monetary regime is in danger.

So writing things out might prove my own thoughts wrong and make me review my investment ideas.

Welcome to my mess.

We're living through schizophrenic times.

Investors are changing their minds intra-minute.

Sell-side analysts and economists have missed massive turn arounds.

Governments and Central Banks have done the impossible.

Capitalism's face has changed.

And the future of the current monetary regime is in danger.

So writing things out might prove my own thoughts wrong and make me review my investment ideas.

Welcome to my mess.

Subscribe to:

Comments (Atom)